Form ST-3 Sales and Use Tax Return - Georgia (United States)

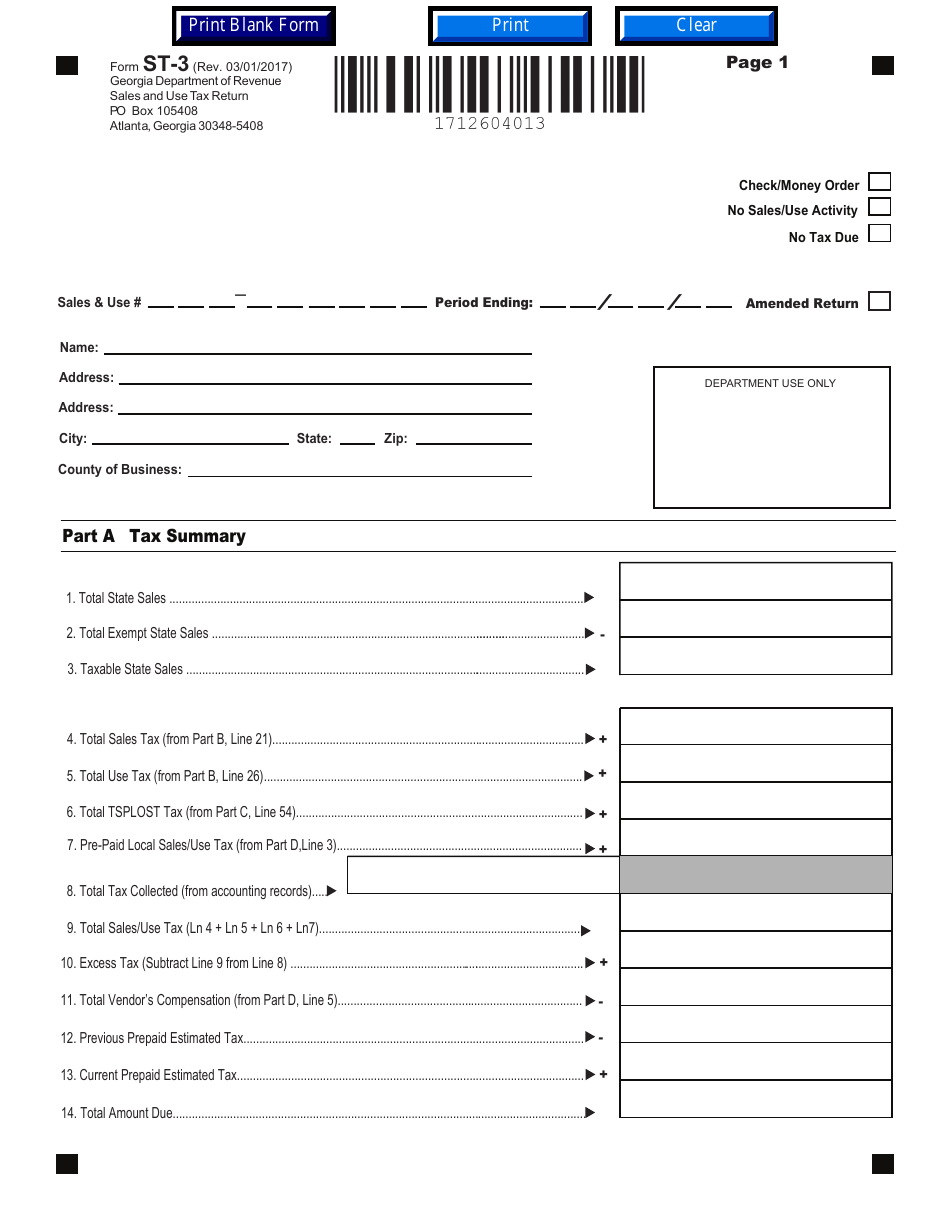

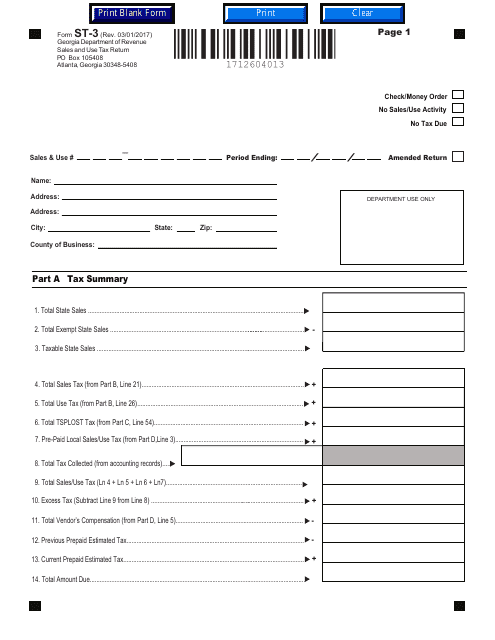

Form ST-3, Sales and Use Tax Return , is an official document used by Georgia-registered organizations to report the sales and use tax they owe. This statement helps the government to learn more about the business activity of your company, its total sales, and their accurate distribution.

This form was issued by the Georgia Department of Revenue . The latest version of the document was released on March 1, 2017 , with all previous editions obsolete. You may download ST-3 Form via the link below.

ADVERTISEMENT

Georgia Form ST-3 instructions

Follow these steps to prepare Form ST-3:

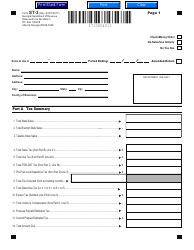

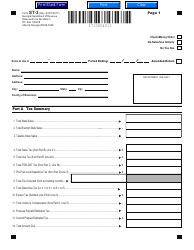

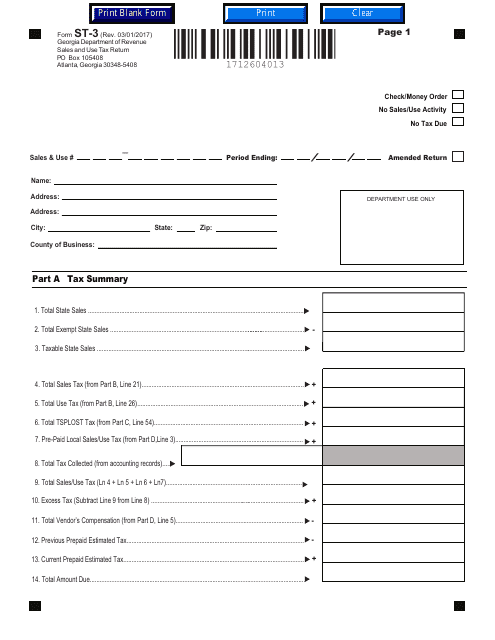

- State the sales and use tax number assigned to your business . Indicate the time period you are filing the return for. Check the box if you are submitting an amended form, owe no tax, or had no activity related to sales and use. Identify the taxpayer by name and address.

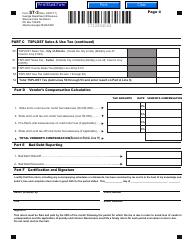

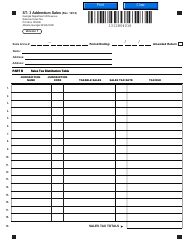

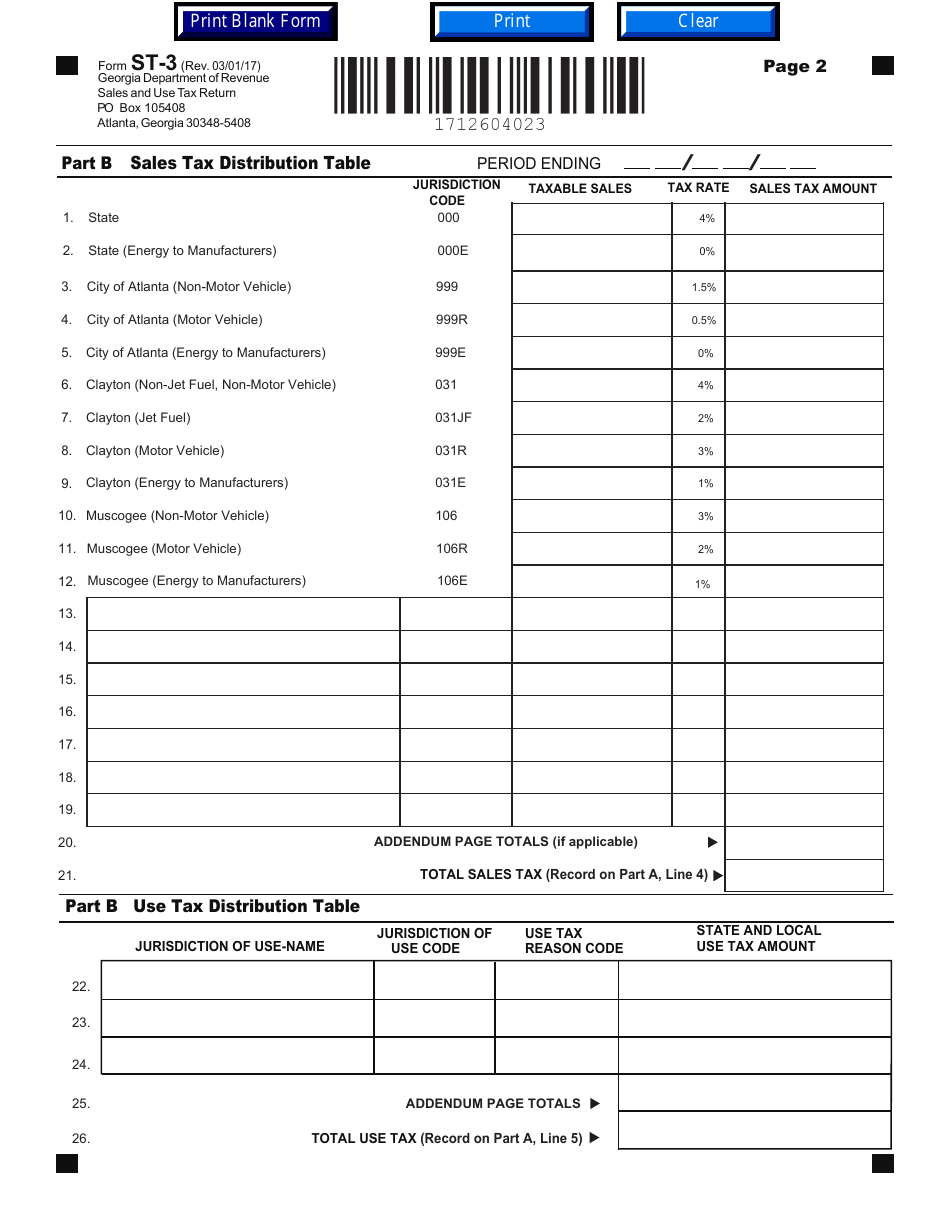

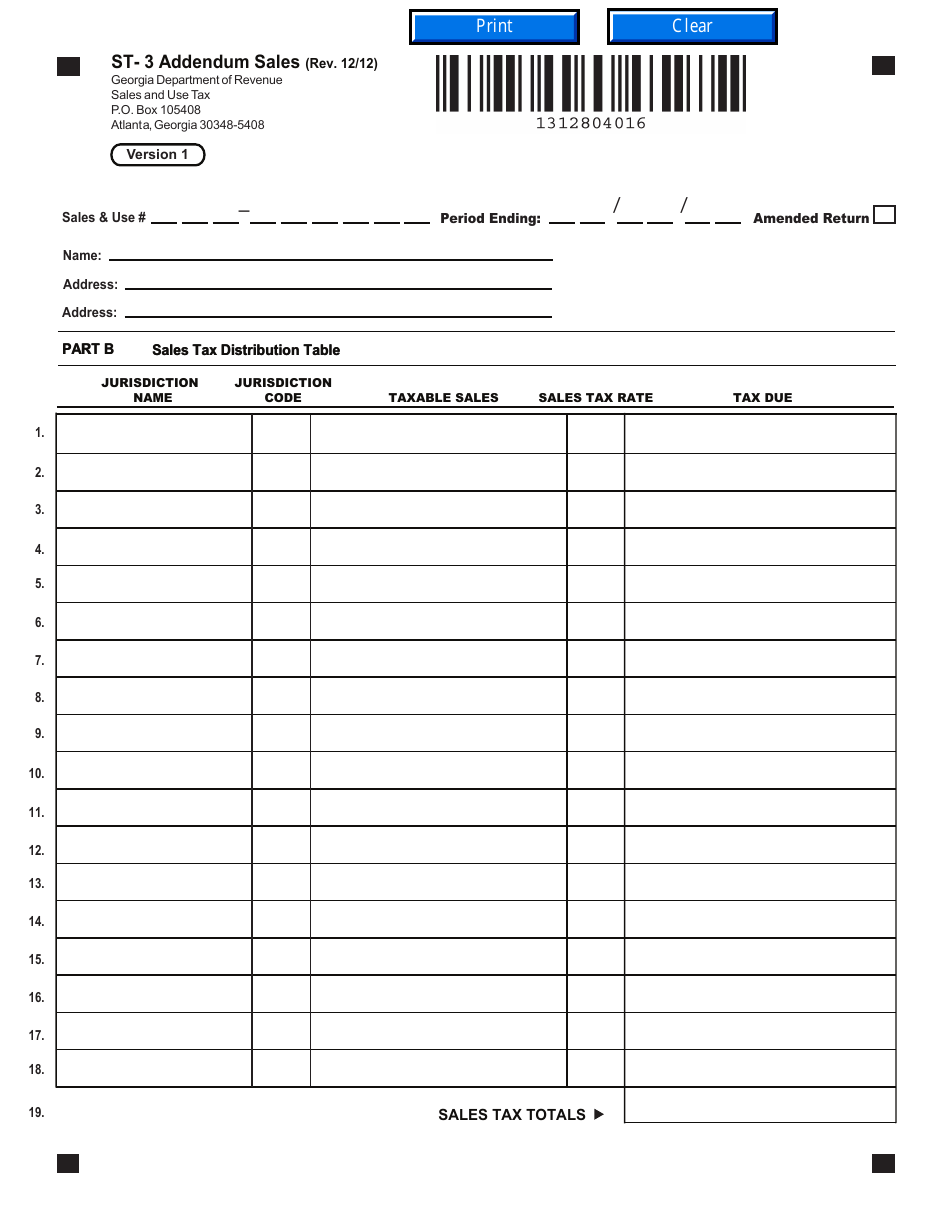

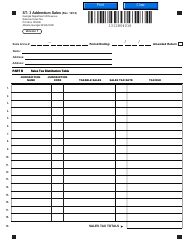

- Examine the table to see how the sales tax is distributed . There are different rates for different jurisdictions - it depends on the county the service or product was first used in Georgia. Add all the amounts to figure out the total sales tax.

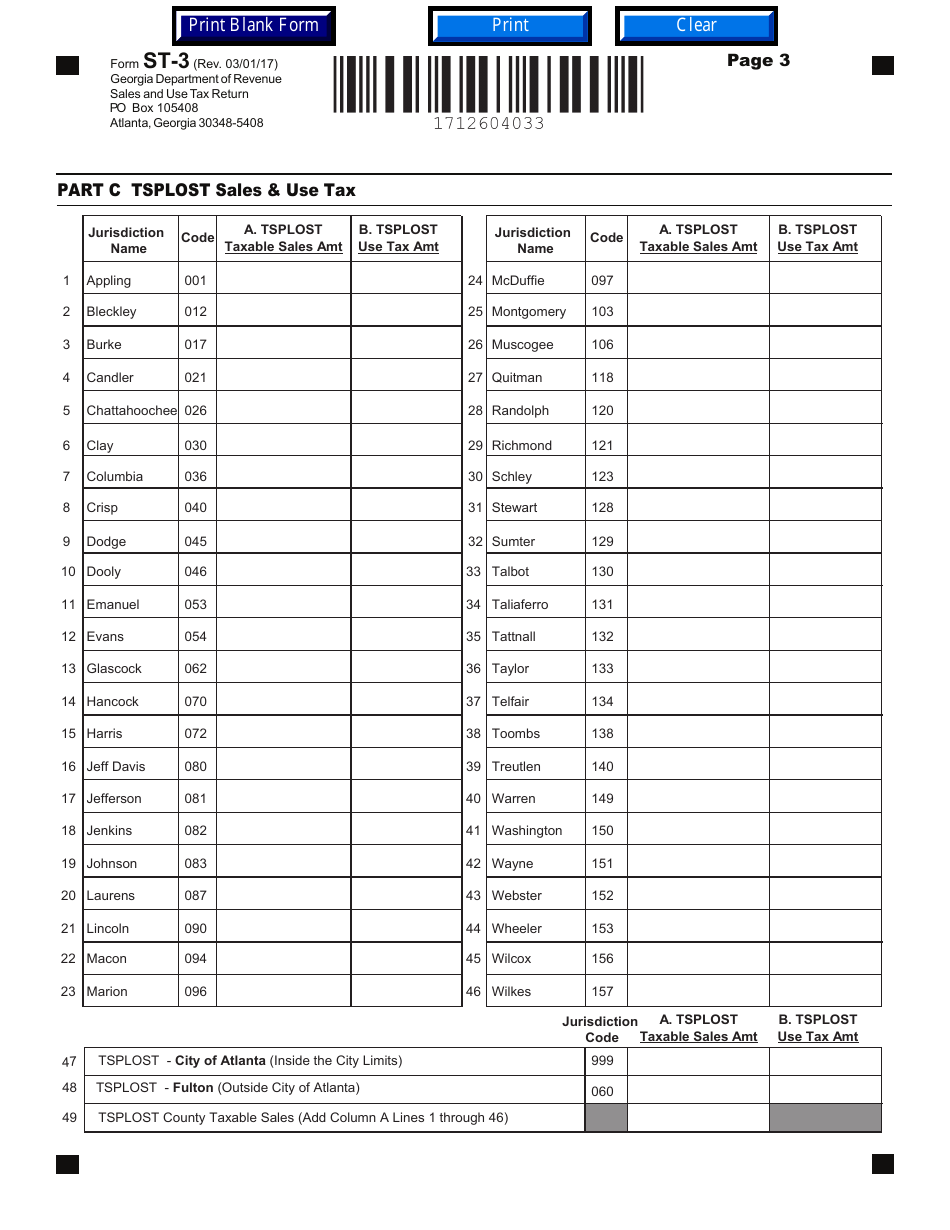

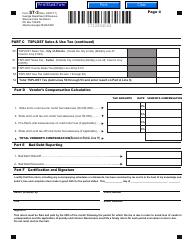

- Indicate the amount of Transportation Local Option Sales Tax you owe . The sales tax and the use tax must be recorded separately and then jointly.

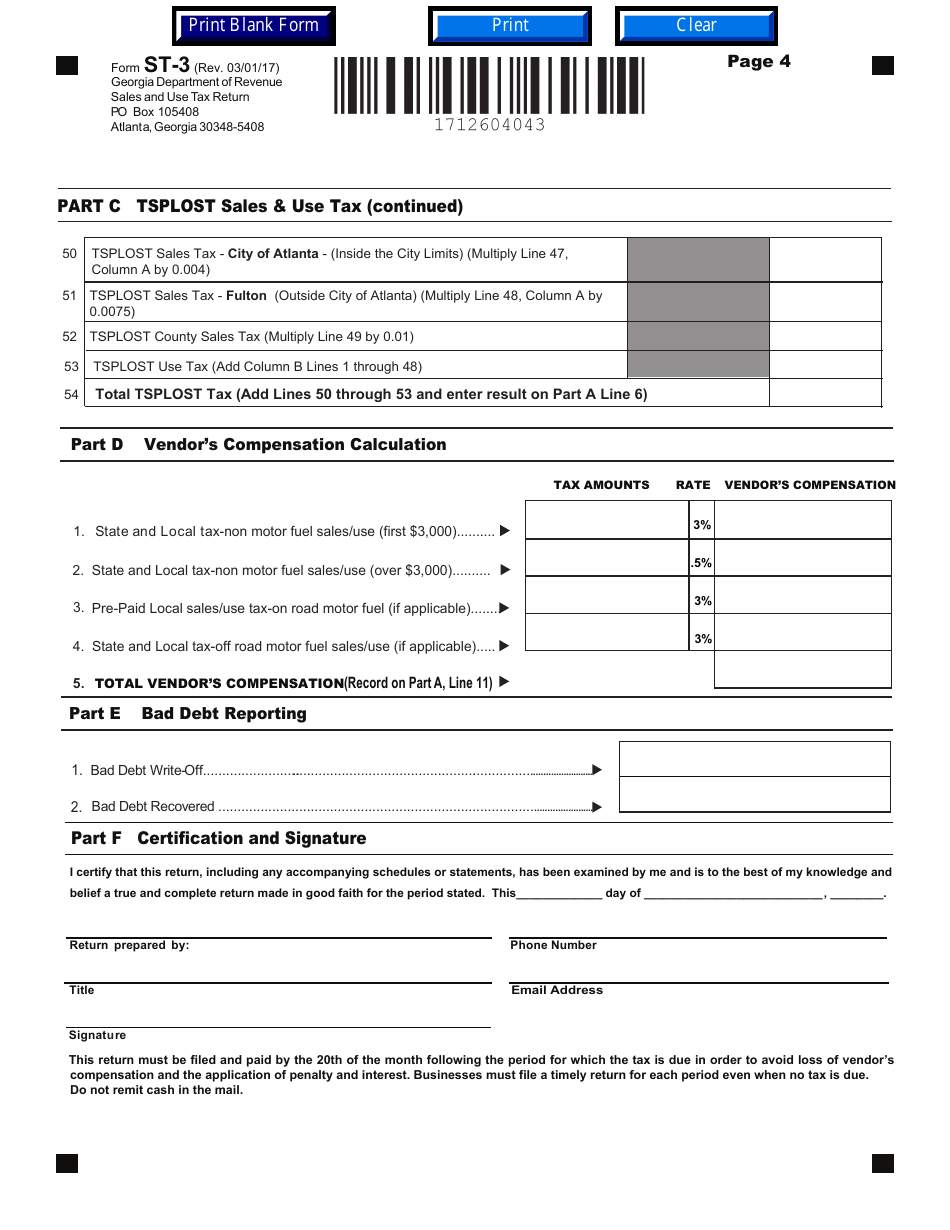

- Compute the vendor's compensation for the sales and use related and not related to the motor fuel sales and use.

- Recognize and enter the amount of bad debt you have written off and recovered.

- Provide a tax summary to list state sales, exempt state sales, and state sales subject to taxation . Enter the total sales tax and use tax from all applicable jurisdictions. Deduct tax you have paid before and the vendor's compensation to find out the total amount of tax you owe.

- Confirm all the details in the form are true and accurate . Name the person who prepared the return, add their title, contact information, and sign the document.

- List all the taxable sales by jurisdiction and write down their total amount.

Download Form ST-3 Sales and Use Tax Return - Georgia (United States)

4.4 of 5 ( 85 votes )

1

2

3

4

5

Prev 1 2 3 4 5 Next

ADVERTISEMENT

Linked Topics

Georgia Sales Tax Form Georgia Tax Forms Georgia Department of Revenue Use Tax Sales Tax Georgia (United States) Legal Forms United States Tax Forms Tax Tax Return Template United States Legal Forms

Related Documents

- Form ST-5 Sales Tax Certificate of Exemption Georgia Purchaser - Georgia (United States)

- Uniform Sales & Use Tax Resale Certificate - Multijurisdiction

- Form ST-4 Sales Tax Certificate of Exemption for out of State Purchaser - Georgia (United States)

- IRS Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

- IRS Form 4720 Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code, 2023

- IRS Form 8928 Return of Certain Excise Taxes Under Chapter 43 of the Internal Revenue Code

- IRS Form 990-PF Return of Private Foundation or Section 4947(A)(1) Trust Treated as Private Foundation, 2023

- IRS Form 1040-SR U.S. Tax Return for Seniors, 2023

- IRS Form 1041 U.S. Income Tax Return for Estates and Trusts, 2023

- IRS Form 1120-S U.S. Income Tax Return for an S Corporation, 2023

- IRS Form 1120-H U.S. Income Tax Return for Homeowners Associations, 2023

- IRS Form 1120-F U.S. Income Tax Return of a Foreign Corporation, 2023

- IRS Form 8038-GC Information Return for Small Tax-Exempt Governmental Bond Issues, Leases, and Installment Sales

- IRS Form 1120-FSC U.S. Income Tax Return of a Foreign Sales Corporation

- IRS Form 1120-REIT U.S. Income Tax Return for Real Estate Investment Trusts, 2023

- IRS Form 1120 U.S. Corporation Income Tax Return, 2023

- IRS Form 1040-SS U.S. Self-employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico), 2023

- IRS Form 14498 Application for Consent to Sale of Property Free of the Federal Tax Lien

- IRS Form 990-T Exempt Organization Business Income Tax Return (And Proxy Tax Under Section 6033(E)), 2023

- IRS Form 1120-L U.S. Life Insurance Company Income Tax Return, 2023

- Convert Word to PDF

- Convert Excel to PDF

- Convert PNG to PDF

- Convert GIF to PDF

- Convert TIFF to PDF

- Convert PowerPoint to PDF

- Convert JPG to PDF

- Convert PDF to JPG

- Convert PDF to PNG

- Convert PDF to GIF

- Convert PDF to TIFF

- Split PDF

- Merge PDF

- Sign PDF

- Compress PDF

- Rearrange PDF Pages

- Make PDF Searchable

- About

- Help

- DMCA

- Privacy Policy

- Terms Of Service

- Contact Us

- All Topics

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

Notice

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.