If you wish to transfer money to someone from the branch of the bank. Then the bank officials will ask you to fill the NEFT/RTGS form. These two systems used to perform money transfers are just amazing. There is no minimum limit for the NEFT and you can use to for amount up to Rs. 10,00,000.

Whereas RTGS is used when the value of the money is more than Rs. 2,00,000. This means you can make use of this system only when you are doing a money transfer for Rs. 2,00,000 and more. But going to the branch and then filling the form takes more time.

So how about filling the form from your place and taking it to the Central Bank of India branch? Now that sounds like we are saving some time. This page will help you to download the Central Bank of India NEFT/RTGS form in PDF format. You take a print out of this application form and fill it to use at the branch. You can download the Central Bank of India NEFT Application form from the official website of the bank. There is a link provided at the end of this page which also can be used to download the form.

When you perform NEFT or RTGS money transfer from the branch of Central Bank of India. You have to pay the bank some transaction charges. I have mentioned the transaction charges below in the table. There is a way to save these below-mentioned charges which I will be discussing with you in a while.

| Transaction Amount | NEFT Service Charges |

| Up to Rs. 10,000 | Rs. 2.5 + GST |

| Rs. 10,001 to Rs. 1,00,000 | Rs. 5 + GST |

| Rs. 1,00,001 to Rs. 2,00,000 | Rs. 15 + GST |

| Above Rs. 2,00,000 | Rs. 25 + GST |

| Transaction Amount | RTGS Service Charges |

| Rs. 2,00,000 to Rs. 5,00,000 | Rs. 24.50 + GST |

| Above Rs. 5,00,000 | Rs. 49.50 + GST |

You can download the NEFT/RTGS application form of the Central Bank of India from the official website by following this download link.

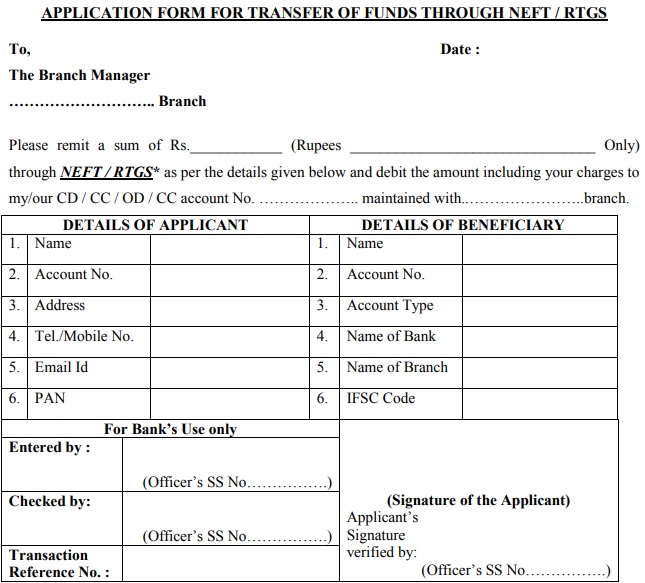

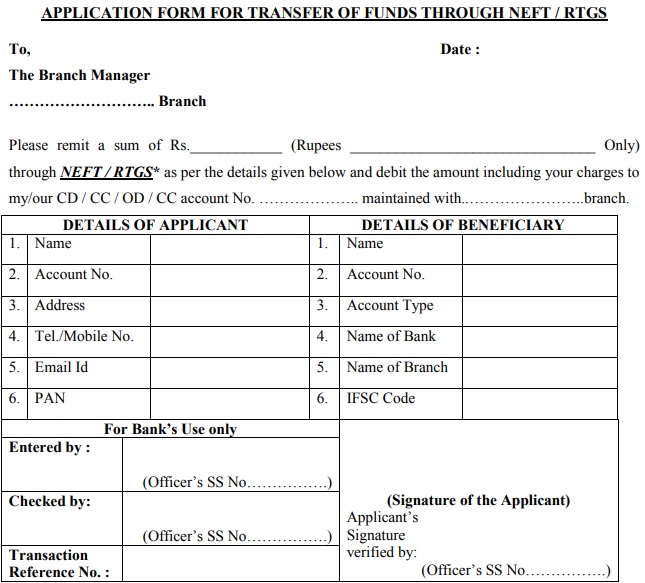

You have to fill the details of both applicant and the beneficiary in the application form along with the details of your home branch. The application form consists of 1 page in which there are two sections. The first is where you have to fill the applicant’s details and the second section should be filled with the beneficiary details.