The Board of Directors and management of Travelers are committed to implementing sound corporate governance practices with the goal of ensuring that the company operates ethically and with integrity and is managed to maximize the long-term interests of its shareholders.

Our commitment to good corporate governance is reflected in our Governance Guidelines, which describe the Board’s views on a wide range of governance topics. These Governance Guidelines are reviewed annually by the Nominating and Governance Committee, and any changes deemed appropriate are submitted to the full Board for its consideration. Our Proxy Statement discusses our robust corporate governance practices, which are designed to support sustained value creation for our shareholders.

The Board works with management to set the short-term and long-term strategic objectives of our company and to monitor progress on those objectives. Strategic topics are generally discussed at each Board meeting, and the Board and management participate in a separate strategy session each year. In setting and monitoring strategy, the Board, along with management, considers the risks and opportunities that impact the long-term sustainability of our business model and whether the strategy is consistent with our core values, culture and risk appetite. The Board regularly reviews:

The Board oversees these efforts in part through its standing committees, based on each committee’s responsibilities and areas of expertise. Each committee regularly reports to the Board regarding its areas of oversight responsibility. The Board has allocated and delegated risk oversight responsibility to its committees in accordance with the following principles:

Each committee is also responsible for monitoring reputational risk to the extent arising out of its area of responsibility.

Each Board committee has a written charter, which contains specific responsibilities, including the risk oversight functions listed above.

With a focus on continually improving the ability of the Board to provide informed oversight, the Nominating and Governance Committee oversees educational sessions for directors on matters relevant to our company, business strategy and risk profile. For example, topics of those sessions have focused on the role that corporate culture and board oversight played in publicized lapses in corporate governance at other firms.

The Board and each of its committees evaluate the allocation of oversight responsibility at least annually, along with their respective performance and effectiveness.

To learn more about the specific risk oversight functions delegated to each Board Committee and our Enterprise Risk Management activities, see the Capital & Risk Management section of this site, and view our Proxy Statement to see specific Board Committee responsibilities.

With respect to oversight of ESG-related risks and opportunities, each committee is assigned responsibility for oversight of matters most applicable to its charter responsibilities. We believe that allocating responsibility to a committee with relevant knowledge and experience improves the effectiveness of the Board’s oversight. For example, as indicated above, the Audit Committee oversees risks related to regulatory and compliance matters; the Compensation Committee oversees implementation of our pay-for-performance philosophy and practices designed to ensure equitable pay across the organization; the Nominating and Governance Committee oversees our workforce diversity and inclusion efforts, public policy initiatives and community relations; and the Risk Committee oversees strategies pertaining to management of catastrophe exposure, changing climate conditions and information technology, including cybersecurity.

In addition, our Chief Sustainability Officer and our management-level ESG Committee – a multidisciplinary committee consisting of senior company executives that meets at least quarterly – drive the prioritization and management of, and reporting on, sustainability issues. We also regularly engage with our investors, our customers, our employees, our agents and brokers, regulators, rating agencies and other stakeholders on business issues and the ESG topics of interest to them.

To learn more about our shareholder engagement, including with respect to ESG matters, please see our Proxy Statement.

To learn more about our stakeholder engagement and how we identify our priority sustainability topics, see the About Our Sustainability Reporting section of this site.

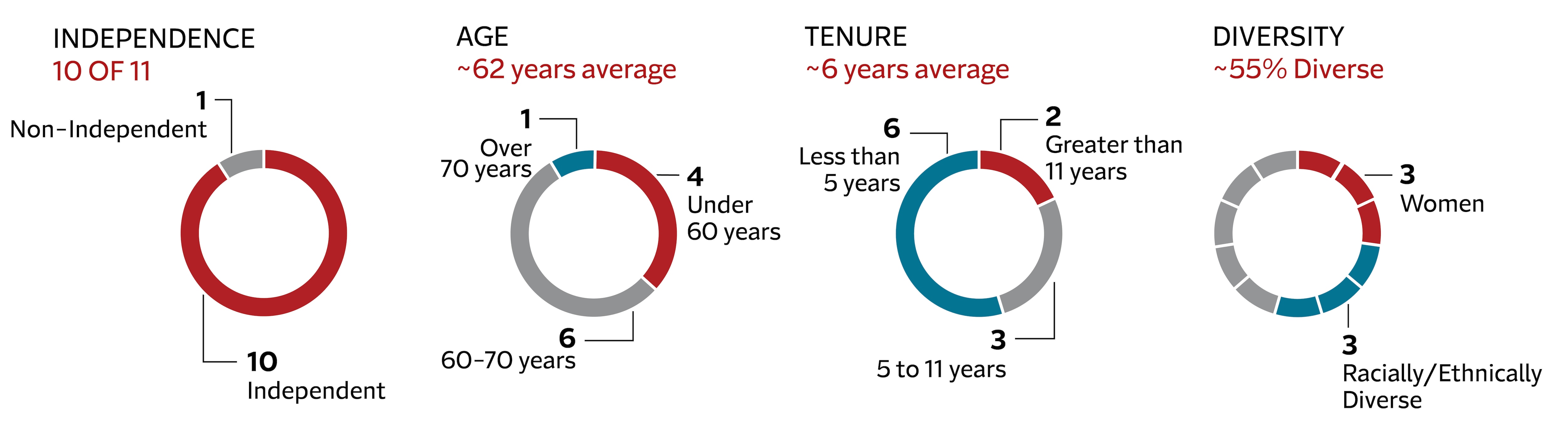

An effective and independent Board of Directors is critical to good corporate governance. All of our directors, other than our Chairman and CEO, are independent. All committees are comprised of independent directors, other than the Executive Committee on which our Chairman and CEO serves.

The Board has an independent Lead Director. The independent Lead Director coordinates the efforts of the independent directors and has the authority to, among other things, convene and chair meetings of the independent directors as deemed necessary, as well as to approve the Board meeting schedules and meeting agenda items.

To further ensure effective independent oversight, independent members of the Board regularly meet in executive session with no members of management present. Executive sessions are chaired by the independent Lead Director. Each of the committees also meets regularly in executive session. For additional information on our Board structure and the role of the independent Lead Director, see our Governance Guidelines and our Proxy Statement.

The members of the Board have a broad range of skills, expertise, industry knowledge, viewpoints and backgrounds and include three women and three racially/ethically diverse directors. The Board and the Nominating and Governance Committee carefully consider the importance of diverse viewpoints, backgrounds and experiences and other demographics when selecting future director nominees. The Board seeks to ensure that it is composed of members whose particular expertise, qualifications, attributes and skills, when taken together, allow the Board to satisfy its oversight responsibilities effectively.

Another factor considered in board composition is maintaining a balanced approach to board refreshment, with the intent of ensuring an appropriate mix of long-serving and new directors. Our Governance Guidelines contain a director age limit, providing that no person who will have reached the age of 74 before the annual shareholders meeting will be nominated for election at that meeting without an express waiver by the Board. The Board believes that waivers of this policy should not be automatic and should be based upon the needs of the company and the individual attributes of the director.

Director_Snapshot_Accordion

Our director and executive compensation programs are designed to reinforce a long-term perspective and to align the long-term interests of our executives and directors with those of our shareholders.

With our pay-for-performance philosophy and compensation objectives as our guiding principles, we deliver annual executive compensation through the following elements:

CEO Compensation Mix

Other Names Executive Officers (NEOs)

Base salaries are appropriately aligned with the Compensation Comparison Group.

Performance-Based Cash

Annual Cash Bonus

The Compensation Committee evaluates a broad range of financial and nonfinancial metrics in awarding performance-based incentives.

Core return on equity is a principal factor in the Compensation Committee’s evaluation of the company’s performance.

The Committee also considers other metrics, including core income and core income per diluted share, and the metrics that contribute to those results.

Performance-Based Equity

Long-Term Stock Incentives

Annual awards of stock-based compensation are typically in the form of stock options and performance shares. Because our performance shares only vest if specified core return on equity thresholds are met, and because stock options provide value only if our stock price appreciates, the Compensation Committee believes that such compensation is all performance-based.

The mix of long-term incentives for the CEO and other named executive officers is 60% performance shares and 40% stock options, based on the grant date fair value of the awards.

For more detail regarding our executive compensation program, see the Compensation Discussion and Analysis section of our Proxy Statement .

Travelers Articles of Incorporation and Bylaws, together with our Governance Guidelines, define and protect our shareholders’ rights, including through:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

4 circle graphs that represent Independence, Age, Tenure and Diversity of directors.

First graph: Independence - 10 of 11 of our directors are independent. 1 is non-independent.

Second graph: Age - Directors are on average 62 years. 4 are under 60 years, 6 are between 60-70 years and 1 is over 70 years.

Third graph: Tenure - Directors have an average of 6 years. 6 less than 5 years, 3 between 5 to 11 years and 2 greater than 11 years.

Fourth graph: Diversity - 55% of our board is diverse, with 3 women and 3 racially/ethnically diverse directors.

Travelers and The Travelers Umbrella are registered trademarks of The Travelers Indemnity Company in the U.S. and other countries.

© 2024 The Travelers Indemnity Company. All rights reserved.

IMPORTANT LEGAL INFORMATION

This site contains information about Travelers. Travelers disclaims any duty or obligation to update such information. Any “forward-looking statement” is made only as of the date such information was originally prepared by Travelers and is intended to fall within the safe harbor for forward-looking information provided in the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, may be forward-looking statements. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “ensures” and other similar expressions are used to identify these forward-looking statements. These statements include, among other things, statements about our future results of operations and financial condition; our share repurchases and dividends; our strategy and competitive advantages; our strategic operational initiatives to improve profitability and competitiveness; our new product offerings; our innovation agenda; our investment portfolio, including our investment analysis and approach; our risk management, including climate-related strategies, risks and opportunities; our catastrophe modeling, including statements about probabilities or likelihood of exceedance; our scenario analyses; our cybersecurity, business resiliency and data privacy; our human capital management, including diversity and inclusion efforts; our underwriting and pricing strategy, policies and practices; and our carbon footprint. Results may differ materially from those expressed or implied by forward-looking statements. Factors that can cause results to differ materially include those described under “Forward-Looking Statements” in the corporation's most recent Form 10-K and Form 10-Q filed with the Securities and Exchange Commission, and with respect to our scenario analyses, those factors described under "Climate Scenario Analysis With Respect to the Hurricane Peril" and "Climate Scenario Analysis With Respect to Our Investment Portfolio" in Travelers TCFD Report included on this site.

On this site, we may refer to some non-GAAP financial measures. For a reconciliation of these measures to the most comparable GAAP measures and a glossary of certain financial measures, see the Non-GAAP Reconciliations page.

This site may contain links to other internet sites and may frame material from other internet sites. Such links or frames are not endorsements of any products or services in such sites, and no information in such sites has been endorsed or approved by Travelers.

Except where noted, the information covered on this site highlights our performance and initiatives in fiscal year 2023.

The inclusion of information on this site should not be construed as a characterization regarding the materiality or financial impact of that information. For additional information regarding Travelers, please see our current and periodic reports with the Securities and Exchange Commission, including our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

Travelers and The Travelers Umbrella are registered trademarks of The Travelers Indemnity Company in the U.S. and other countries.

© 2024 The Travelers Indemnity Company. All rights reserved.

S&P Global Market Intelligence (“SPGMI”) Disclaimer. Information obtained from SPGMI should not be relied on as investment advice. SPGMI does not guarantee the accuracy or completeness of information obtained from it and shall not be responsible for any errors or omissions with respect to such information or be liable for any results or losses arising out of the use of such information. Reproduction of SPGMI information is prohibited without the prior written permission of SPGMI.